Attain Your Desires with the Assistance of Loan Service Professionals

Wiki Article

Check Out Professional Financing Solutions for a Seamless Loaning Experience

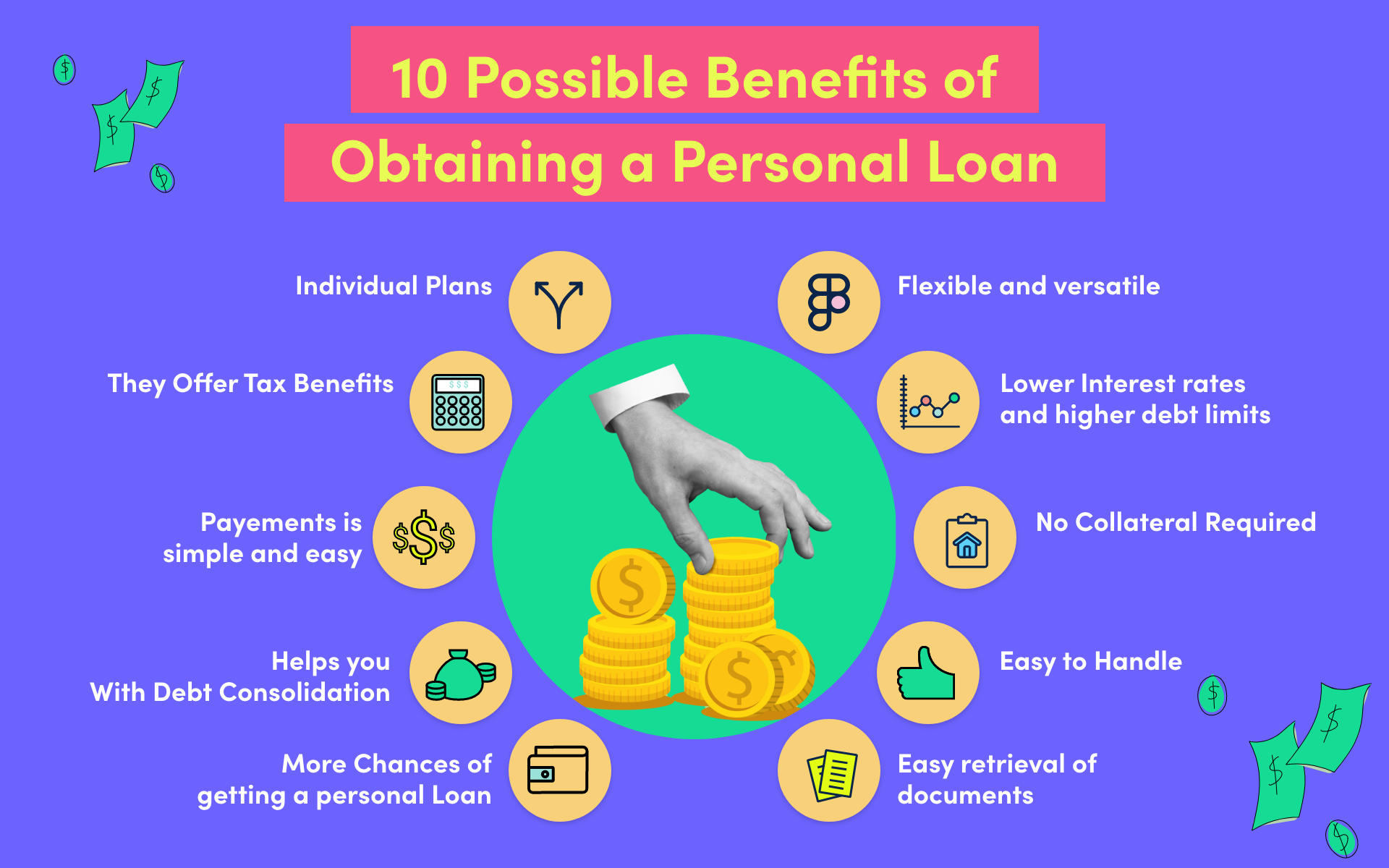

Professional loan solutions provide a path to navigate the intricacies of borrowing with accuracy and proficiency. From customized car loan remedies to customized advice, the globe of expert loan solutions is a world worth exploring for those looking for a borrowing trip marked by effectiveness and simplicity.Advantages of Expert Lending Providers

Specialist financing solutions provide expertise in browsing the complicated landscape of borrowing, giving customized solutions to satisfy certain financial needs. Expert financing services usually have established partnerships with loan providers, which can result in faster approval procedures and better settlement outcomes for consumers.

Picking the Right Lending Company

Having actually identified the advantages of expert lending solutions, the next crucial step is selecting the ideal funding service provider to fulfill your details economic needs successfully. mca lending. When selecting a financing provider, it is vital to think about numerous crucial aspects to guarantee a smooth loaning experience

To start with, review the online reputation and credibility of the financing supplier. Study client testimonials, rankings, and reviews to assess the fulfillment levels of previous customers. A credible finance supplier will certainly have transparent conditions, excellent customer support, and a record of reliability.

Second of all, compare the passion rates, costs, and repayment terms supplied by different lending service providers - merchant cash advance companies. Search for a supplier that supplies affordable prices and flexible repayment choices tailored to your monetary circumstance

Furthermore, take into consideration the finance application process and approval timeframe. Select a company that provides a streamlined application process with quick approval times to access funds promptly.

Streamlining the Application Refine

To enhance performance and ease for candidates, the funding company has actually carried out a structured application process. This polished system aims to streamline the borrowing experience by minimizing unnecessary paperwork and speeding up the authorization process. One essential function of this streamlined application procedure is the online platform that permits candidates to send their details electronically from the comfort of their own homes or workplaces. By getting rid of the need for in-person brows through to a physical branch, candidates can save time and finish the application at their ease.:max_bytes(150000):strip_icc()/6-benefits-of-using-a-credit-union.aspx_final-6e501699186e429ab6458d9e36ebe4a1.jpg)

Comprehending Loan Conditions

With the structured application process in location to streamline and quicken the borrowing experience, the next critical step for applicants is acquiring a comprehensive understanding of the financing terms. Understanding the conditions of a loan is important to make certain that customers are conscious of their obligations, legal rights, and the general expense of borrowing. Secret elements to take note of consist of the rate of interest, payment timetable, any kind of associated fees, penalties for late settlements, and the complete quantity repayable. It is crucial for borrowers to carefully review and understand these terms prior to accepting the lending to avoid any surprises or misconceptions later. In addition, consumers need to ask about any type of provisions connected to early settlement, re-financing choices, and potential adjustments in rates of interest with time. Clear interaction with the lending resource institution pertaining to any kind of uncertainties or inquiries regarding the terms and conditions is encouraged to cultivate a transparent and mutually beneficial loaning connection. By being well-informed about the car loan terms and conditions, consumers can make sound economic decisions and navigate the loaning process with self-confidence.Making Best Use Of Car Loan Approval Opportunities

Securing approval for a loan requires a calculated approach and comprehensive prep work for the borrower. To make best use of finance approval opportunities, people should begin by examining their credit scores records for precision and addressing any inconsistencies. Preserving an excellent credit report is crucial, as it is a significant element thought about by loan providers when assessing creditworthiness. Furthermore, decreasing existing financial obligation and preventing handling new financial obligation before requesting a finance can show economic duty and improve the possibility of approval.Additionally, preparing a comprehensive and realistic spending plan that details income, expenditures, and the recommended lending settlement plan can display to loan providers that the customer is qualified of managing the added financial commitment (mca lenders). Giving all necessary documents promptly and accurately, such as proof of revenue and work history, can streamline the approval process and instill confidence in the lender

Conclusion

In conclusion, professional financing solutions use numerous advantages such as expert assistance, tailored loan alternatives, and raised authorization opportunities. By selecting the appropriate loan service provider and understanding the terms and problems, customers can improve the application process and ensure a smooth borrowing experience (Loan Service). It is essential to meticulously take into consideration all facets of a lending prior to dedicating to guarantee economic security and successful settlementReport this wiki page